Inflation affects the real estate market in different ways. It can make interest rates higher and home prices rise. In addition to that, higher interest rates can protect the purchasing power of the currency and prevent hyperinflation. Higher interest rates can also lead to increased profits for banks. As a result, you should avoid investing in rental properties during periods of inflation.

Construction cost inflation outruns other measures of inflation

Construction cost inflation has outpaced other measures of inflation on the real estate market in recent years. Inflation in the construction industry is often linked to commodity prices, which drives up building costs and constrains new supply. In turn, this makes existing real estate investments more valuable.

According to the most recent government statistics, construction costs have increased by 3% in the past year. This is largely because of labor costs, which make up thirty to thirty percent of the overall project. While the non-residential sector has grown by 10% over the past six years, the volume of work added by this sector will rise only by four percent after accounting for inflation.

Although construction cost inflation is driven by labor and material costs, a large portion of the inflation is due to changes in contractor margins. Higher construction volumes tend to drive up contractor margins. However, while the average inflation rate in a down year is about one percent, the rate in 2021 is well over eight percent.

The increase in construction costs has a direct effect on house prices. It can also affect the bid margin. Moreover, the level of construction activity can affect material and labor demand, which can drive up construction cost inflation. A low level of construction activity can make house prices fall, while a high level of activity could lead to a corresponding increase in house prices. prestige park grove

Rent increases are more likely than mortgage payments

The effects of inflation on the real estate market are being felt by millions of households across America. Inflation has fueled price increases on everything from sofas to cars, but rents have been increasing more rapidly than those costs, largely because of tighter supply conditions. According to Redfin, a brokerage, the average asking rent has increased by 15.2 percent over the past year. This increase in rent is not surprising given the shortage of housing, which has been crippling the housing market for years.

The rise in rent prices is expected to continue, though the most expensive states have already started to level off. Inflation is expected to push up rent prices at a 6% rate this year, which would be double seasonal rates from years before the housing crisis began. As rent prices rise, landlords can expect to generate more net cash flow than they would have without inflation, as higher rents will offset rising costs of managing rental properties.

Inflation increases the overall demand for goods and services. This leads to higher spending, which in turn leads to higher prices. Inflation also causes the price of products to rise as more materials are needed to produce them. Inflation also raises the costs of building a home. As a result, investors have had a hard time finding rental properties that are priced competitively.

Investing in rental properties during periods of inflation

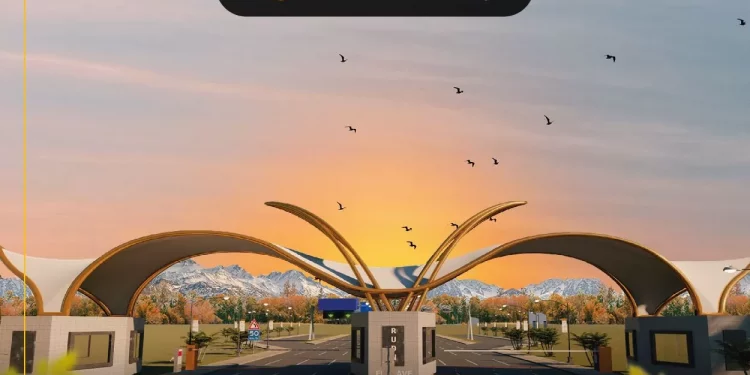

Inflation can be good for real estate investors, but it can also hurt their bottom line. Inflation has a tendency to raise prices and slash the purchasing power of cash, stocks, and bonds.kingdom valley islamabad prices increases in this inflation. As a result, real estate investors are seeking ways to protect their capital during periods of inflation. Rental real estate is a great way to do this. Investing in rental property provides a steady return on your investment as well as the opportunity to pass the cost of inflation to your tenants.

Investing in rental properties during periods of high inflation can increase your profits, as rising prices can push up the prices of homes and rents. Inflation also affects construction costs, but real estate can offset the cost of construction and tenants. As a result, investors can take advantage of these rising costs by raising the rents of their rental properties, which in turn will help them stay afloat as inflation increases. This makes it a safer investment than low-yield savings accounts.

Another reason to invest in rental properties during periods of inflation is that there is always demand for rental housing. Because people need somewhere to live, rental properties will continue to be in high demand like rudn enclave demand, regardless of economic conditions. This trend is also true for millennials and Gen Z, who tend to rent instead of owning their own homes.

Also read about: Adarsh Park Heights